If you can't come up with enough money to make your new import/export business a success, or if you lack some of the skills needed, consider a partnership. A partnership is an association of two or more persons engaging in a profit-making business as co-owners. A partnership is similar in many respects to a sole proprietorship, with the exception of sharing responsibilities and profits.

Although a formal partnership agreement isn't a legal requirement, it's in the best interest of all partners to have an attorney develop one that clearly details the status and responsibilities of each partner. A standard partnership agreement should include the following:

The name of the partnership

The purpose of the business

The domicile of the business (where the business will be located)

The duration of the partnership (how long the agreement will be in effect)

Names of all partners and their legal addresses

Performance requirements of the partners (a statement of each partner's individual management role and duty)

Contributions of each partner to the business (this includes each partner's investment in the business; you may also want to include contributions such as experience and sales contact)

An agreement on how to distribute the profits or losses of the partnership

An agreement on the salaries or drawing rights against profits for each partner (how much money each partner will take from the business as a salary)

An agreement on how the partnership might expand through the addition of a new partner

How the assets of the partnership will be distributed if the partners agree to dissolve the partnership

The steps required if a partner wants to sell his interest in the partnership

What happens if one of the partners is absent or disabled

The procedures necessary to alter or modify the partnership agreement

In a partnership, a person can be classified as either a general partner or a limited partner. Each partnership agreement must have at least one general partner, who has unlimited personal liability and plays an active role in the management of the business. A limited partner has limited liability and can lose only the amount of money she's invested. There's no restriction on the number of limited partners, but they can't play an active role in the management of the business.

Pros of a partnership

Here are the advantages of a partnership:

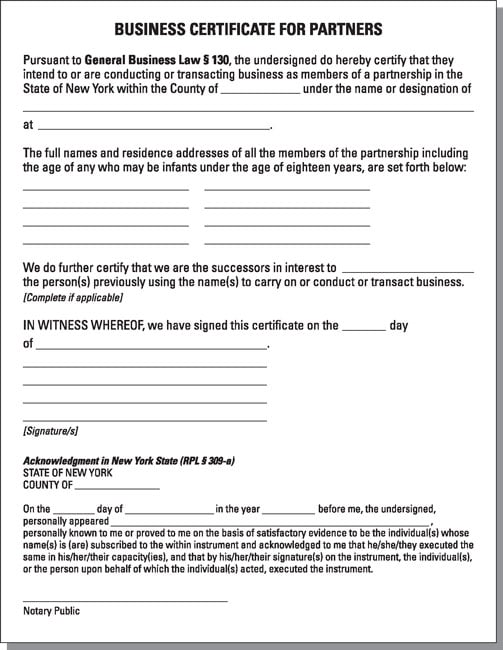

A partnership is easy and inexpensive to establish. In most states, the owner must file a business certificate for partners (similar to the one shown) with the local authorities and obtain any necessary business licenses.

In a successful partnership, the skills and abilities of each partner usually complement each other. This makes for a much stronger organization.

A partnership has access to a larger base of capital and credit. Each partner's assets increase the available pool of capital, which enhances the ability to borrow funds.

A partnership is flexible. Although a partnership isn't as flexible as a sole proprietorship, partners can generally react quickly to changes.

A partnership comes with certain tax incentives. The partnership itself is not subject to federal taxation. As with a proprietorship, the profits or losses that a partnership earns or incurs are personal income, and taxes are paid on the partners' personal tax rates. Each partner must be provided with a Schedule K-1 from the partnership, showing his share of the income or losses. Note: Partners are required to pay taxes on the share, even if none of that income is distributed to them.

A business certificate for partners.

A business certificate for partners.

Cons of a partnership

Here are the disadvantages of a partnership:

At least one partner faces unlimited liability. Every partnership must have at least one general partner, and like a sole proprietor, a general partner has unlimited personal liability for the debts of the business. In addition, a general partner's liability is joint and several, which means that creditors can hold all general partners equally responsible for the partnership's debts, or they can collect the entire debt from just one partner. The limited partner doesn't face this disadvantage, because her liability is limited to the amount of money she's invested in the business.

A partnership is terminated when a partner dies or withdraws from the agreement. The sale of a partnership interest has the same effect as the death or withdrawal of a partner. Coming up with a fair value for the business that everyone can agree on is usually difficult, but it's easier if the partnership agreement specifies a method of valuation.

In a partnership, the partners may have personality conflicts that affect the success of the partnership. Even if you're best friends when you start the partnership, that may change as you work together. Conflicts between partners can be the undoing of an otherwise successful venture.