Latin American countries dominate the sugar trade; Brazil is the largest sugar producer in the world. In 2009, the top ten sugar producers accounted for 74 percent of global production.

| Country | Sugar Production (Millions of Tons) |

|---|---|

| Brazil | 36 |

| E.U. | 18 |

| India | 17 |

| China | 13 |

| Thailand | 8 |

| United States | 7 |

| South Africa | 6 |

| Mexico | 5 |

| Australia | 4.5 |

| Russia | 4 |

Source: United States Department of Agriculture

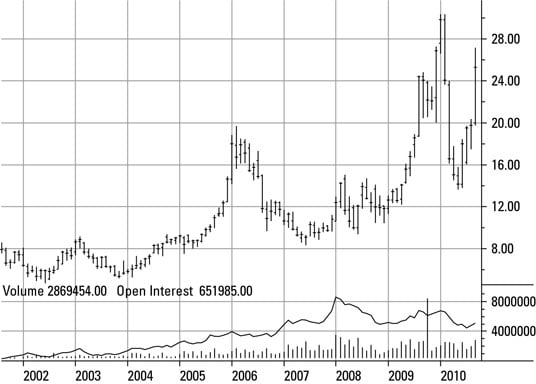

If you’re interested in investing in sugar, the ICE offers two futures contracts that track the price of sugar: Sugar #11 (world production) and sugar #14 (U.S. production). Consider the contract specs for these two sugar contracts:

Sugar #11 (World)

Contract ticker symbol: SB

Contract size: 112,000 pounds

Underlying commodity: Global sugar

Price fluctuation: $0.01 per pound ($11.20 per contract)

Trading months: March, May, July, and October

Sugar #14 (USA)

Contract ticker symbol: SE

Contract size: 112,000 pounds

Underlying commodity: Domestic (U.S.) sugar

Price fluctuation: $0.01 per pound ($11.20 per contract)

Trading months: January, March, May, July, September, and November

On a historical basis, sugar #14 produced in the United States tends to be more expensive than sugar #11. However, sugar #11 accounts for most of the volume in the ICE sugar market.