You may be thinking that valuing ending inventory is a no-brainer — you just value inventory at whatever the original cost happened to be for whatever is left in inventory at the end of the financial period, right? Well, to a certain extent, yes.

Here's the scoop on how to use a systematic cost flow assumption to determine which items that the company previously purchased remain in inventory at the end of the financial period (and come up with a dollar amount for both cost of goods sold and ending inventory).

Generally accepted accounting practices (GAAP) allow three different cost flow assumptions: specific identification; weighted average; and first in, first out (FIFO).

Specific identification valuation method

Use the specific identification method when the inventory items are easily differentiated. Good examples of companies that can use this method are car dealerships and ritzy jewelry stores with one-of-a-kind creations. It’s relatively easy to trace back the exact cost of each individual item in inventory because each item is special and unique or is equipped with a serial number that can be traced back to its purchase price.

For example, a used car dealership can quickly identify how much it cost to originally purchase vehicles on the lot by matching the description of the car or the vehicle identification number (VIN) to the purchase invoice.

So if the dealership pays the auto auction $1,500 for a used Buick, inventory goes up by $1,500. When a customer buys the Buick, the dealership’s accounting department increases cost of goods sold for $1,500 and decreases inventory for the same amount; the dealership then reduces ending inventory by that same $1,500.

You figure ending inventory for the balance sheet by adding the total of all payments made to the particular vendors from whom the company purchased the inventoried goods.

Weighted average valuation method

When a company uses the weighted average method, inventory and the cost of goods sold are based on the average cost of all units purchased during the period. This method is generally used when inventory is substantially the same, such as with grains, fuel, and metal.

So if the company sells steel rods, the total cost of all the rods available for sale is divided by the total number of steel rods in inventory. Then the company multiplies that figure by the number of steel rods remaining in inventory at the end of the accounting period to get the ending inventory dollar amount.

First in, first out (FIFO) valuation method

Using the FIFO method, the company assumes that the oldest items in its inventory are the ones first sold. So the items remaining in ending inventory are always assumed to be the most recent purchase additions to inventory, regardless of whether they actually are.

Consider buying milk in a grocery store. The cartons with the most current expiration date are pushed ahead of the cartons that have more time before they go bad. The oldest cartons of milk may not always actually be the first ones sold (because some people dig around looking for later expiration dates), but the business is basing its numbers on the oldest cartons being sold first.

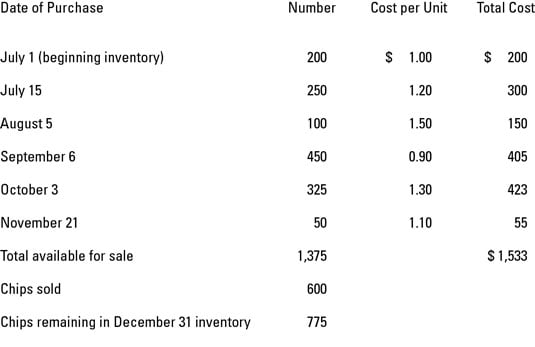

Consider an example. The following figure shows bags of potato chips in beginning inventory and purchases for Norfolk Mini-Mart from July 1 to the end of the calendar year (no purchases were made in December).

600 bags of chips were sold, leaving 775 bags in inventory. Your next step is to figure out the cost of goods sold and value ending inventory using the FIFO cost flow assumption.

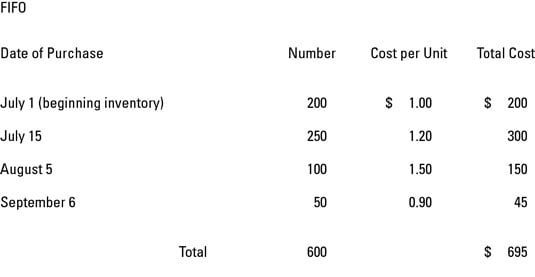

Using FIFO, you start at the top of the list because the bags of chips in beginning inventory are first in. Then you follow with the chips purchased on July 15, the chips purchased on August 5, and 50 of the 450 chips purchased on September 6. As you can see from the following figure, the cost of goods sold (COGS) is $695 and ending inventory is $838 ($1,533 – $695).