Unlike other commodities that are dominated by single producers — Saudi Arabia and oil, the Ivory Coast and cocoa, Russia and palladium — no one country dominates wheat production. As a matter of fact, the major wheat producers are a surprisingly eclectic group. The advanced developing countries of China and India are the two largest producers, while industrial countries like Canada and Germany also boast significant wheat production capabilities.

| Country | Wheat Production (Millions of Tons) |

|---|---|

| China | 115 |

| India | 81 |

| Russia | 61 |

| United States | 60 |

| France | 38 |

| Canada | 26.5 |

| Germany | 25.2 |

| Pakistan | 24 |

| Australia | 21 |

| Ukraine | 21 |

Source: U.S. Department of Agriculture

Wheat is measured in bushels for investment and accounting purposes. Each bushel contains approximately 60 pounds of wheat. As for most other agricultural commodities, metric tons are used to quantify total production and consumption figures on a national and international basis.

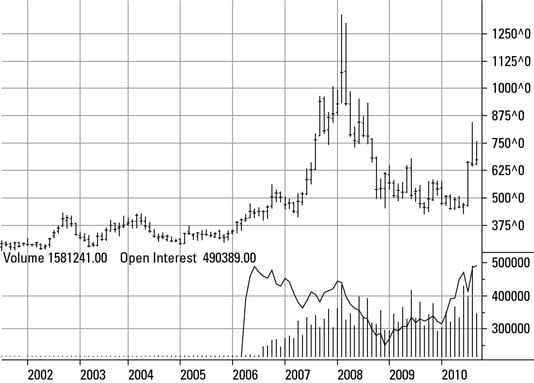

The most direct way of accessing the wheat markets, short of owning a wheat farm, is by trading the wheat futures contract. As with the other agricultural commodities, the Chicago Board of Trade (CBOT) offers a futures contract for those interested in capturing profits from wheat price movements — whether for hedging or speculative purposes. Here are the specs for the CBOT futures contract:

Contract Ticker Symbol: W

Electronic Ticker: ZW

Contract Size: 5000 Bushels

Underlying Commodity: Premium Wheat

Price Fluctuation: $0.0025/bushel ($12.50 per contract)

Trading Hours: 9:30 a.m. to 1:15 p.m. Open Outcry, 6:32 p.m. to 6:00 a.m. Electronic (Chicago Time)

Trading Months: March, May, July, September, December

Wheat production, like that of corn and soybeans, is a seasonal enterprise subject to various output disruptions. Kazakhstan for instance, an important producer, has faced issues with wheat production in the past due to underinvestment in machinery and the misuse of fertilizers. This mismanagement of resources has an impact on the acreage yield, which in turn impacts prices. Such supply side disruptions can have a magnified effect on futures prices.

Interested in finding out more about the wheat market? Try the following sources:

A number of organizations that offer information on specific commodities, such as corn and wheat, are specialized lobby groups whose agenda —alongside providing information to the public — includes promoting the consumption of the products they represent. Keep this in mind as you consult any outside resource for research purposes.

According archaeologists, wheat is one of the first agricultural products grown by man. Evidence suggests that wheat production developed in the Fertile Crescent region, an area that encompasses modern day Turkey and Syria.

Today wheat is the second most widely produced agricultural commodity in the world (on a per volume basis), right behind corn and ahead of rice. World wheat production came in at 618 Million Metric Tons in 2005, according to the USDA.