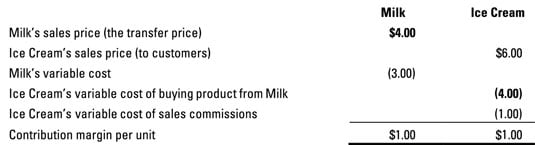

In order for both divisions to share profits more equally, managers may prefer to set the transfer price at variable cost plus a markup. At Ernie’s Western Dairy, President Ernie Hill decides to set the transfer price at variable cost plus a $1 markup, resulting in a transfer price of $4 ($3 variable cost plus $1 markup).

To see how the Milk and Ice Cream divisions now share profits, take a look at the following figure. Fair is fair, and now the two divisions split their contribution margins equally: $1 goes to each.

Setting the transfer price at variable cost plus markup can lead to problems, though. Suppose that the Ice Cream division receives a special order to supply a local summer camp with 1,000 gallons of ice cream. Competitors offer to sell ice cream for $4.80 per gallon. How low can Ernie’s Western Dairy Ice Cream division go?

The Ice Cream division figures that its variable costs equal the $4 transfer price plus another $1 in sales commissions. That makes $5, well over the competitors’ price of $4.80. Therefore, Ice Cream division would probably skip this opportunity.

And yet, if you consider the real cost of the ice cream, Ernie’s would have been better off if Ice Cream had cut its price. After all, because making a gallon of milk costs the Milk division only $3, total cost for the ice cream is really $4 ($3 variable cost to the Milk division plus $1 sales commission).

Ernie’s could’ve bid $4.75 per gallon on the summer camp account and still earned $0.75 contribution margin on each gallon sold.

Setting the transfer price at variable cost plus a markup, therefore, can lead to decisions that aren’t in the best interest of the company as a whole. To avoid this scenario, Milk division must share its information about the real cost of the milk, even if that cost is lower than the transfer price. Furthermore, the divisions sometimes need to forgo their own profits in order to do what’s most profitable for the whole company.