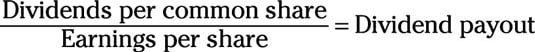

When a company earns money, it can choose to distribute those earnings out to its shareholders in the form of dividends. Investors calculate the percentage of earnings used for dividend payouts to common shareholders like this:

To use this equation, follow these steps:

Find the dividends per common share on the income statement and determine the earnings per share.

Divide the dividends per common share by the earnings per share to get the dividend payout.

The number you get is the percentage of earnings that dividends compose. The importance of this percentage is two-fold. First, higher dividend payout ratios are an important part of the portfolio strategies of those investors who like to have a steady income from their investments.

Second, the ratio of earnings that companies pay out in dividends provides an indicator of the company’s future plans for growth. Low dividend payout with no expansion may indicate trouble; the same is true for high dividend payout in a growing company.

Generally speaking, large or stagnating companies tend to have higher dividend payout ratios, while small or growing companies tend to retain those earnings to reinvest in growth.

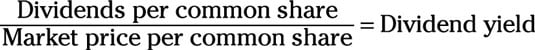

What would you be willing to pay for the dividends that a company distributes? For those investors who are concerned with the amount of income they’ll generate from the dividends on stock they own, calculating the dividend yield is critical, as this metric tells them how much income they’ll generate in the form of dividends for the price they pay on each share of stock.

Comparing the dividend yield of different companies can help tell you whether you’re getting a competitive level of dividend-based income for the price:

Here’s how to put this equation to use:

Find the dividends per common share near the bottom of the income statement and check the equities market or ask your broker to find the market price per common share.

Divide the dividends per common share by the market price per common share to calculate the dividend yield.

The dividend yield determines what percentage of the price an investor pays for his shares was issued in the last year in dividends. Keep in mind that the amount of dividends issued each year can change, meaning that the dividend yield can be an unreliable measure unless the company you’re measuring has a history of maintaining a fairly consistent dividend payout each year.