One of the downsides of investing in commodity Exchange-Traded Funds (ETFs) is that they can be fairly volatile because they track derivative instruments that trade in the futures markets. A downside of the DBC specifically is that it tracks a basket of only six commodities. However, more commodity ETFs are in the pipeline that will offer greater diversification benefits.

As you can see, you can now access a broad variety of commodity markets through ETFs, ranging from livestock and natural gas all the way to uranium and palladium.

| ETF | Category | Ticker |

|---|---|---|

| Dow Jones–AIG Commodity Index Total Return | Broad index | NYSE: DJP |

| Deutsche Bank Commodity Index Tracking Fund | Broad index | NYSE: DBC |

| Goldman Sachs Commodity Index Total Return | Broad index | NYSE: GSG |

| Dow Jones–AIG Agriculture Total Return ETN | Agriculture index | NYSE: JJA |

| streetTRACKS Gold Shares ETF | Gold | NYSE: GLD |

| iShares Gold Trust ETF | Gold | NYSE: IAU |

| iShares Silver Trust Fund | Silver | NYSE: SLV |

| Dow Jones–AIG Aluminum ETN | Aluminum | NYSE: JJU |

| United States Natural Gas Fund | Natural gas | NYSE: UNG |

| United States Oil Fund | Crude oil | NYSE: USO |

| Dow Jones–AIG Livestock Total Return ETN | Livestock index | NYSE: COW |

| ETFS Physical Palladium Shares ETF | Palladium | NYSE: PALL |

| ETFS Physical Platinum Shares ETF | Platinum | NYSE: PPLT |

| Global X Global Gold Explorers ETF | Gold exploration | NYSE: GLDX |

| Global X Global Silver Explorers ETF | Silver exploration | NYSE: SIL |

| Global X Lithium ETF | Lithium metal | NYSE: LIT |

| Global X Uranium ETF | Uranium metal | NYSE: URA |

| Emerging Global Energy Titans Index | Energy companies | NYSE: EEO |

As commodities become a more accepted asset class, more ETFs are likely to launch and be available for you to trade. For the latest on ETF products, check out Commodities Investors LLC.

These ETFs are some of the most popular ones in the marketplace today.

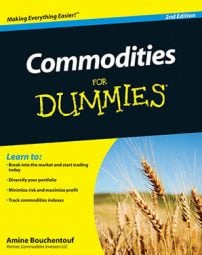

United States Oil Fund (AMEX: USO): The Unites States Oil Fund (USO) is an ETF that seeks to mirror the performance of the West Texas Intermediate (WTI) crude oil futures contract on the New York Mercantile Exchange (NYMEX).

Although the ETF doesn’t reflect the movement of the WTI contract tick by tick, it does a good job of broadly mirroring its performance. It’s a good way to get exposure to crude oil without going through the futures markets.

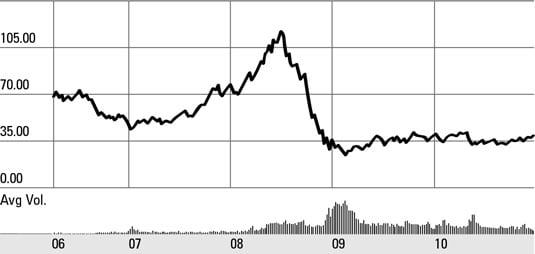

streetTRACKS Gold Shares (AMEX: GLD): This ETF seeks to mirror the performance of the price of gold on a daily basis. The fund actually holds physical gold in vaults located in secure locations, to give investors the ability to get exposure to physical gold without having to hold gold bullion.

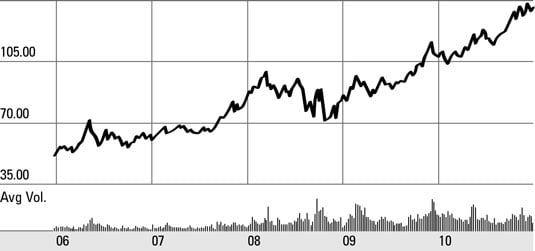

iShares Silver Trust (AMEX: SLV): This ETF is the first ever to track the performance of the price of physical silver. Like the gold ETF, the silver ETF holds actual physical silver in vaults. It’s a safe way to invest in the silver markets without going through the futures or physical markets.

Another newcomer to the ETF marketplace is the Aluminum ETF, launched by Dow Jones & AIG. Aluminum has always been an important metal because it’s one of the building blocks of construction, industry, and infrastructure. With many important uses and applications, investors and traders worldwide closely follow this metal. For the first time, investors can get exposure to this important metal.