An unpaid charge-off often makes its way to a lawyer sooner or later and that can be very bad for your credit. A collection attorney may take your case to court, you may have a judgment entered against you, you’ll lose a day to court and incur additional legal expenses, and maybe, your wages will be garnished for up to 25 percent of your take-home pay.

This is about as much fun as a legal colonoscopy. If you get a court summons for a hearing on a debt issue, answer it!

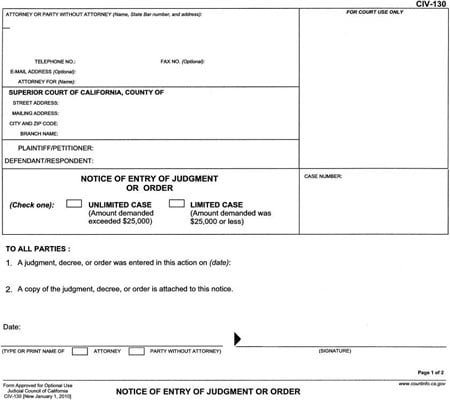

The legal side of the collection process typically begins with a letter. After months of phone assaults, a simple mute letter is easy to ignore. Don’t! The letter is a summons telling you that a court hearing will be held on a certain date in a certain place. You are strongly advised to show up with a plan and, if possible, an attorney. A good plan includes

A short explanation of why you haven’t paid

Any disputes about the bill or collection process so far

A plan to repay the debt on terms you can afford

Documentation that shows why you can’t afford more

If the debt is valid (not in dispute or belonging to someone else) and hasn’t been collected, the court generally issues an order confirming that you owe money and commanding you to pay it. This order is called a judgment, and it involves legal fees, public record information on your credit report, and dealing with a system that doesn’t fool around

If you get one of these, you need to wake up and get a repayment plan going. If you dishonor, or ignore, a judgment, the next step could be wage garnishment.

The judgment itself doesn’t force you to pay the debt. It does, however, set you up for execution — not execution as in the electric chair, but a judgment execution:

If you receive a judgment and you still don’t pay, the lender can go back to the judge and get an execution order. Depending on the laws in your state, the order allows the creditor to

Garnish your wages up to 25 percent.

Place a lien on your home or other property for the amount owed. A lien is like having another mortgage on the property. Before the property can be sold or mortgaged, the lien has to be paid off.

Repossess any property involved with the debt you owe (for example, your furniture if it’s a furniture loan).

A judgment is a very serious development in the collection process. At this point, many people seriously consider bankruptcy to wipe out their debts. Unfortunately, for many people who earn above the median income in their states, bankruptcy is no longer an attractive option.

This is one of the reasons consulting a professional early in the game makes a lot of sense. If you don’t have the option to file bankruptcy, you want to know as soon as possible.