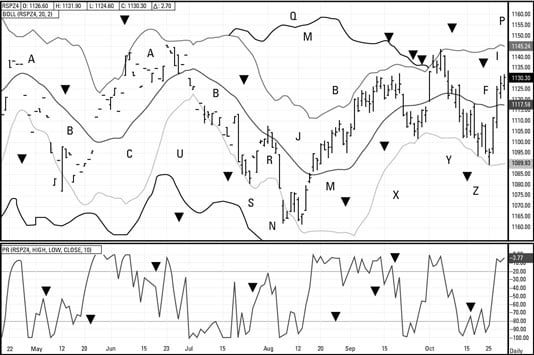

Imagine a hypothetical daily pricing pattern for a hypothetical ETF that we will give the hypothetical ticker symbol UGH. What you see at point A is a major reversal pattern known to technical analysts as the “Head-and-Shoulders.” Notice that as the price dips below the “Neckline” and then rises with simultaneous “Increased Volume” that the “Reversal” of the “Trend” begins to manifest. Buy! Buy!!

Within a short time, however, as you can clearly see at point B, a “Minor Top” forms indicating an “Upward Trend” reinforced by the classic “Inverted Triangle.” Sell! Sell!! Two minutes later, at point C, where volume increases yet again and the price again rises a point, we see a “Breakaway Gap.” Buy! Buy! Buy!

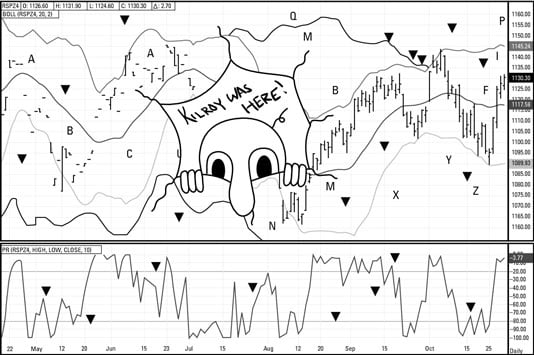

In the next chart, you can examine the daily pricing patterns of a hypothetical ETF that is hypothetically called DUM. You can make millions overnight if you truly understand this charting pattern!

Unless you are totally humor challenged, by now you see that this is not entirely serious. Many, if not most, day-traders (who just love ETFs, especially the really kooky ones) believe in something called technical analysis: the use of charts and graphs to predict movements in securities. Much of the language used to explain the chart for UGH, as well as the basic idea behind the charts, comes from a best-selling book on technical analysis.

The key to success in investing isn’t to do a lot of trading based on secret formulas every bit as fruitless as alchemy. The key is to keep your investment costs low (ETFs will do that for you), diversify your portfolio (ETFs can do that, too), lose as little as possible to taxes (ETFs can help there, too), and exercise patience (that part’s up to you).

Buying and holding, more or less, with regular rebalancing, is the thing to do. Yes, that’s true even in today’s uber-turbulent markets. You will see that the true champions of the investing world are those with the most patience. Here’s a great quote that you may want to post next to your computer to look at the next time you contemplate swapping one ETF for another. It’s from someone who knows a little bit about investing.

The stock market is a method for transferring money from the impatient to the patient. —Warren Buffet