The commodity crude oil by itself doesn’t have many useful applications — it needs to be refined into consumable products such as gasoline and jet fuel. Refineries are a critical link in the crude oil supply chain because, after crude oil is discovered, that oil needs to be transformed into products before it’s sent to consumers.

Here are some of the products refineries derive from refining crude oil:

Asphalt

Automotive lubricating oil

Diesel fuel

Gasoline

Heating oil (commercial and residential)

Jet fuel (military and commercial aviation)

Kerosene

Petrochemicals

Propane

Given the importance of these derivative products, you can imagine that you can make a lot of money investing in refineries. You need to look at three criteria when considering investing in companies that operate refineries:

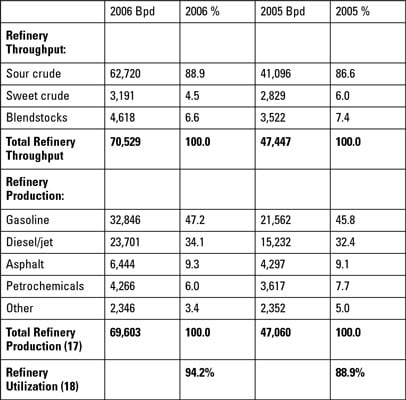

Refinery throughput: The capacity for refining crude oil over a given period of time, usually expressed in barrels

Refinery production: Actual production of crude oil products, such as gasoline and heating oil

Refinery utilization: The difference between production capacity, the throughput, and what’s actually produced

You can find this information in a company’s annual or quarterly reports.

The largest refinery in the United States is located in Baytown, Texas, and is operated byExxonMobil. It has a refining capacity of 557,000 barrels per day. Most major integrated oil companies have a large refining capacity. These include some of the majors, like ExxonMobil and BP. One way to get exposure to the refining space is to invest in these major companies.

Another, more direct, way to profit from refining activity is to invest in independent refineries. The marquee name in this area is a company called The Valero Energy Corporation (NYSE: VLO). Valero is the largest independent refining company in North America.

Valero is nice because, if you want to play the refinery card, it gives you one of the most direct ways to do so. The major integrated companies are a good play, but they’re so big that you don’t get the same kind of direct exposure you do from Valero.

Although Valero is the goliath in the refinery space, a number of smaller companies can offer you a lot of value. Take a look at a couple of these companies:

Sunoco Inc. (NYSE: SUN): Sunoco is the second-largest refiner in terms of total refinery throughput. It refines approximately 1 million barrels of crude oil a day into refined products, which it distributes primarily in the eastern United States.

Tesoro Corp. (NYSE: TSO): Tesoro, headquartered in San Antonio, Texas, is one of the leading refiners in the midcontinental and western United States. Its refineries transform crude oil into gasoline that’s distributed through a network of about 500 retail outlets in the western United States. This option is a good regional play.

Refiners operate in an extremely cyclical industry, which poses an inherent investment risk that favors only the most savvy operators. Independent refiners must purchase the raw material — crude oil — at market prices and must resell the finished product — gasoline, heating oil, and so on — at market prices.

However, many majors also operate internal refineries that compete aggressively with the independents; whereas the independents must purchase the raw material at market prices, however, internal refineries often get oil at subsidized prices. This market dynamic makes it extremely difficult for independents to compete on an equal footing with the majors. Keep this in mind as you’re analyzing independent refiners.

The Energy Information Administration compiles data on all U.S. refineries.