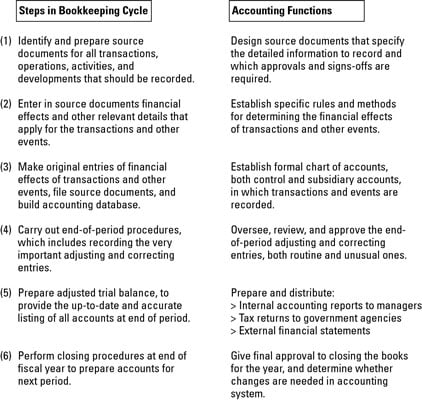

Business managers must ensure that their company’s bookkeeping and accounting system is adequate and reliable. The steps in the bookkeeping cycle have corresponding accounting functions. It’s important for bookkeepers and accountants to have a clear idea of what it takes to be sure that the information coming out of the accounting system is complete, timely, and accurate.

The following illustration presents an overview of the bookkeeping cycle side-by-side with elements of the accounting system. The basic bookkeeping steps appear on the left side. The accounting elements are shown in the right column.

The basic steps in the bookkeeping sequence are as follows:

Prepare source documents for all transactions, operations, and other events of the business; source documents are the starting point in the bookkeeping process.

For example, when buying products, a business gets a purchase invoice from the supplier. When a customer uses a credit card to buy the business’s product, the business gets the credit card slip as evidence of the transaction. When preparing payroll checks, a business depends on salary rosters and time cards. All of these key business forms serve as sources of information into the bookkeeping system.

Determine and enter in source documents the financial effects of the transactions and other events of the business.

Transactions have financial effects that must be recorded. Examples of typical business transactions include paying employees, making sales to customers, borrowing money from the bank, and buying products that will be sold to customers.

The bookkeeping process begins by determining the relevant information about each transaction. The chief accountant of the business establishes the rules and methods for measuring the financial effects of transactions.

Make original entries of financial effects into journals and accounts, with appropriate references to source documents.

Using the source document(s) for every transaction, the bookkeeper makes the first, or original, entry into a journal and then into the business’s accounts. A journal is a chronological record of transactions in the order in which they occur. In contrast, an account is a separate record for each asset, each liability, and so on. One transaction affects two or more accounts. The journal entry records the whole transaction in one place; then each piece is recorded in the two or more accounts that are affected by the transaction.

Perform end-of-period procedures — the critical steps for getting the accounting records up-to-date and ready for the preparation of management accounting reports, tax returns, and financial statements.

A period is a stretch of time — from one day to one month to one quarter (three months) to one year — that is determined by the needs of the business. A year is the longest period of time that a business would wait to prepare its financial statements.

Before the accounting reports can be prepared at the end of the period, the bookkeeper needs to bring the accounts of the business up-to-date and complete the bookkeeping process. One step, for example, is getting an actual count of the business’s inventory so that the inventory records can be adjusted to account for shoplifting, employee theft, and other losses.

The accountant needs to take the final step and check for errors in the business’s accounts. Data entry clerks and bookkeepers may not fully understand the unusual nature of some business transactions and may have entered transactions incorrectly. One reason for establishing these internal controls is to keep errors to an absolute minimum.

Compile the adjusted trial balance for the accountant, which is the basis for preparing reports, tax returns, and financial statements.

After all the end-of-period procedures have been completed, the bookkeeper compiles a complete listing of all accounts, which is called the adjusted trial balance. Modest-sized businesses maintain hundreds of accounts for their various assets, liabilities, owners’ equity, revenue, and expenses. Larger businesses may keep thousands of accounts.

In contrast, external financial statements, tax returns, and internal accounting reports to managers contain a relatively small number of accounts. For example, a typical external balance sheet reports only 25 to 30 accounts (maybe even fewer), and a typical income tax return contains a relatively small number of accounts.

The accountant takes the adjusted trial balance and combines similar accounts into one summary amount that is reported in a financial report or tax return. For example, a business may use hundreds of separate inventory accounts. The accountant collapses these accounts into one summary inventory account. In grouping the accounts, the accountant should comply with established financial reporting standards and income tax requirements.

Close the books — bring the bookkeeping for the fiscal year just ended to a close and get things ready to begin the bookkeeping process for the coming fiscal year.

Books is the common term for a business’s complete set of accounts. A business’s transactions are a constant stream of activities that don’t end tidily on the last day of the year, which can make preparing financial statements and tax returns challenging.

The business has to draw a clear line of demarcation between activities for the year (the 12-month accounting period) ended and the year yet to come by closing the books for one year and starting with fresh books for the next year.