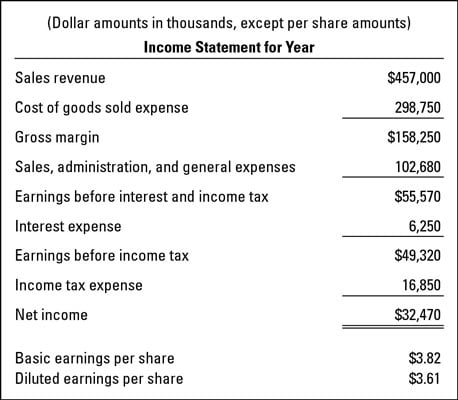

Publicly owned businesses, according to generally accepted accounting principles (GAAP), must report earnings per share (EPS) below the net income line in their income statements — giving EPS a certain distinction among financial ratios.

Why is EPS considered so important? Because it gives investors a means of determining the amount the business earned on their stock share investments: EPS tells you how much net income the business earned for each stock share you own.

The basic EPS ratio

The essential equation for EPS is

Net income ÷ Total number of capital stock shares = EPS

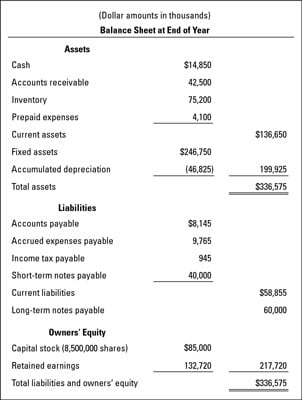

For the example shown in the following figures, the company’s $32.47 million net income is divided by the 8.5 million shares of stock the business has issued to compute its $3.82 EPS.

EPS is extraordinarily important to the stockholders of businesses whose stock shares are publicly traded. These stockholders pay close attention to market price per share. They want the net income of the business to be communicated to them on a per share basis so that they can easily compare it with the market price of their stock shares.

The stock shares of privately owned corporations are not actively traded, so there is no readily available market value for the stock shares. Private businesses do not have to report EPS according to GAAP. The thinking behind this exemption is that their stockholders do not focus on per share values and are more interested in the business’s total net income.

The diluted EPS ratio

The business in the example could be listed on the New York Stock Exchange (NYSE). Assume that its capital stock is being traded at $70 per share. The Big Board (as it is called) requires that the market cap (total value of the shares issued and outstanding) be at least $100 million and that it have at least 1.1 million shares available for trading.

With 8.5 million shares trading at $70 per share, the company’s market cap is $595 million, well above the NYSE’s minimum. At the end of the year, this corporation has 8.5 million stock shares outstanding, which refers to the number of shares that have been issued and are owned by its stockholders. Thus, its EPS is $3.82, as just computed.

But here’s a complication: The business is committed to issuing additional capital stock shares in the future for stock options that the company has granted to its executives, and it has borrowed money on the basis of debt instruments that give the lenders the right to convert the debt into its capital stock.

Under terms of its management stock options and its convertible debt, the business may have to issue 500,000 additional capital stock shares in the future. Dividing net income by the number of shares outstanding plus the number of shares that could be issued in the future gives the following computation of EPS:

$32,470,000 net income ÷ 9,000,000 capital stock shares issued and potentially issuable = $3.61 EPS

This second computation, based on the higher number of stock shares, is called the diluted earnings per share. (Diluted means thinned out or spread over a larger number of shares.) The first computation, based on the number of stock shares actually issued and outstanding, is called basic earnings per share. Both are reported at the bottom of the income statement.

So, publicly owned businesses report two EPS figures — unless they have a simple capital structure that does not require the business to issue additional stock shares in the future. Generally, publicly owned corporations have complex capital structures and have to report two EPS figures, as you see in the first figure above.

Sometimes it’s not clear which of the two EPS figures is being used in press releases and in articles in the financial press. You have to be careful to determine which EPS ratio is being used — and which is being used in the calculation of the price/earnings (P/E) ratio.

Adjusting the EPS ratio

Calculating basic and diluted EPS isn’t always as simple as the example may suggest. Here are just two examples of complicating factors that require the accountant to adjust the EPS formula. During the year, a company may:

Issue additional stock shares and buy back some of its stock shares. (Shares of its stock owned by the business itself that are not formally cancelled are called treasury stock.) The weighted average number of outstanding stock shares is used in these situations.

Issue more than one class of stock, causing net income to be divided into two or more pools — one pool for each class of stock. EPS refers to the common stock, or the most junior of the classes of stock issued by a business.