Retained earnings shows the company’s total net income or loss from its first day in business to the date on the balance sheet. Keep in mind, though, that dividends reduce retained earnings. Dividends are earnings paid to shareholders based on the number of shares they own.

For example, imagine that the company opens its doors on January 2, 2012. On January 2, retained earnings is zero because the company didn’t previously exist. From January 2 to December 31, 2012, the company has a net income of $50,000 and pays out $5,000 in dividends.

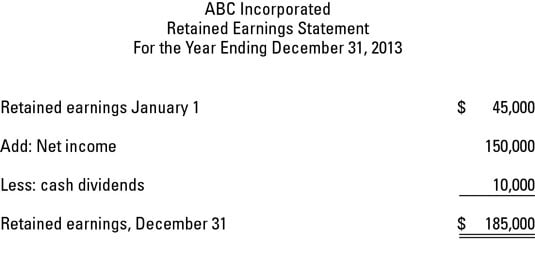

On January 1, 2013, retained earnings is $45,000 ($50,000 – $5,000). To figure retained earnings as of January 1, 2014, you add or subtract the amount of income the company made or lost during 2013 (and subtract any dividends paid) to the $45,000 prior balance in retained earnings.

Following is a retained earnings statement as of December 31, 2013. It includes 2013 income of $150,000 and cash dividends of $10,000.

Sometimes events happen that cause a company to have to restrict retained earnings. A portion is set aside and can’t be used as a basis for declaring dividends. This situation happens often as a result of a clause in a contract: A lender may want to make sure the company doesn’t pay out an excessive amount of its retained earnings, to ensure there’s money for debt payments.