As soon as an error is found, it must be corrected. How you correct the error under GAAP depends on the type of error, the number of financial periods the error affects, how the error affects financial statement presentation, and whether the error is counterbalancing.

To straighten out the messy mistakes and give the users of the financial statements accurate data for ratio analysis, you have to ask yourself these three questions:

What is the type of error? Determine the type of error.

What do you need to do to fix it? Sometimes a simple journal entry is enough. Other times, a direct correction to retained earnings for a prior-period adjustment is on the accounting menu.

Do the financial statements have to be restated? Restatement means previously issued financial statements are revised, to correct the error. If the error is material or prior-period financial statements are shown with the current year, restatement of the financial statements is a must.

How to restate the financial statements

When restating the financial statements, follow these three steps:

Adjust the balances of any assets or liabilities at the beginning of the newest financial period shown in the comparative statements for the cumulative effect of the error.

The other side of the correction goes to retained earnings.

Lastly, you have to correct the error on each of the comparative-year financial statements. Your intermediate accounting textbook may refer to this as period-specific effects.

The notes to the financial statements detail the restatement, giving all necessary info surrounding the event, such as the nature of the error and the effect on net income (both gross and net of income tax).

Walk through error correction

For this example, Robson Corporation discovers the following errors in January 2013 relating to 2012 accounting transactions. The books for the 12 months ending December 31, 2012, are still open. All years prior to January 1, 2012, are closed:

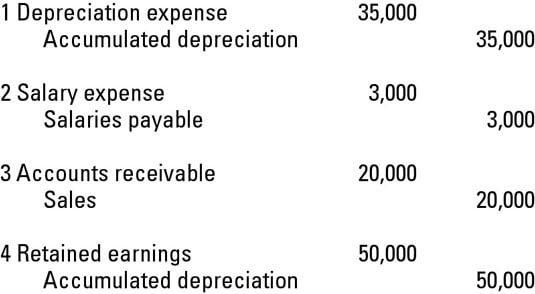

A math mistake was made, and depreciation expense is understated by $35,000.

Robson failed to recognize and accrue salaries payable of $3,000.

The company switches from using the cash method to using the accrual method to book revenue, resulting in understated net sales of $20,000.

Robson further notices that depreciation expense for years prior to January 1, 2012, is understated by an additional $50,000.

The following shows the adjusting journal entries Robson needs to make at December 31, 2012.

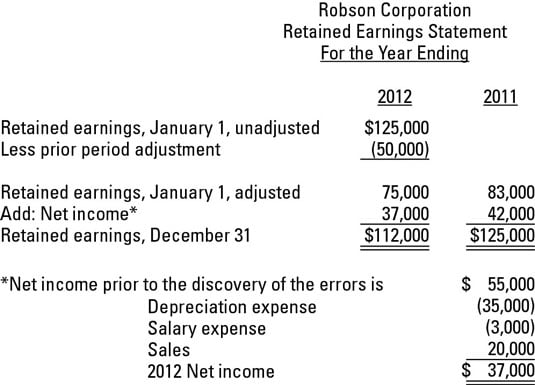

Robson Corporation shows two comparative years, 2011 and 2012, on its statement of retained earnings. The following shows how to reflect the adjusting journal entries.

To recap your GAAP guidelines for changes because of errors:

If you to use the restatement approach:

Correct all prior-period financial statements shown on comparative financial statements.

Restate the beginning balance of retained earnings for the first period shown on a comparative statement of retained earnings if the error is prior to the first comparative period.