To earn money and succeed, a business — whether it’s a service company, a retailer, or a manufacturer — needs to create profits. To generate profits, companies must make sales to customers that exceed however much those sales cost. The three key components of profits are revenues, the cost of sales, and other types expenses. Companies use this information to compute net income.

Revenues, a component of profits

Revenues are inflows from customers. They’re the actual amounts that your customers give you or, in some cases, promise to give you. The term sales is a synonym for revenues.

For example, an airline’s revenues come from selling tickets (and charging baggage fees, handling fees, boarding fees, carry-on fees, and late-arrival fees). A clothing retailer’s revenues come from peddling clothing to customers. A bakery’s revenues come from getting tasty treats to hungry customers.

One caveat: A company obviously can’t record revenue until it knows the actual price and feels assured that the customer will pay. For example, if Michelangelo’s contract requires a team of evaluators to judge a completed work in order to set its price, he can’t record revenue until the actual price is set.

Revenues come only when you sell whatever you usually sell to your customers. If you sell a product you normally don’t sell (say, your delivery truck or the naming rights to your building), you record the inflow as a gain or loss rather than as a revenue.

The cost of sales as a component of profits

Cost of sales is the cost of buying or making the products that you sell. For example, suppose that a soft-drink bottler sells a can of cola for $0.50. Consider what goes into that can of cola:

Water

Caramel color

Carbonation

Sweeteners

Natural flavors

Caffeine

Various preservatives

Aluminum

Labor

Overhead

Now, given all these (inexpensive) ingredients and costs, consider how much it probably costs to produce a can of cola. Would you say $0.15 per can?

Because they don’t manufacture the goods themselves, when retailers measure cost of sales, they base it on the amount of money they paid to purchase the goods from a supplier.

Many manufacturers and retailers use the term cost of goods sold instead of cost of sales. This point often confuses students, so don’t be alarmed if your head is spinning a little. Just know that regardless of the name, these two concepts are largely the same thing.

Don’t confuse the accounting treatment for cost of goods sold with the cost of unsold goods. When buying or making goods, companies record the cost of unsold goods on the balance as inventory — an asset. Then, when the goods are sold, their cost is taken out of inventory and put into cost of sales, which is subtracted from revenue on the income statement.

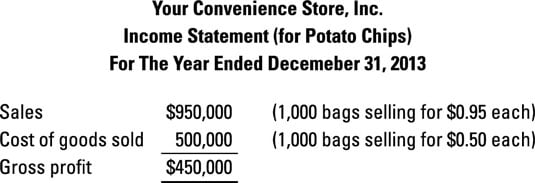

Say you own a convenience store that sold 1,000 bags of chips last year. The chips cost you $0.50 per bag, for a total cost of $500, but you sold them for $0.95 per bag, for total revenues of $950. Use this information to construct the beginning of an income statement (where all revenue and expenses are reported).

Operating expenses are a component of profits

Sales don’t just materialize by themselves. To bring in sales, you must pay employees, advertisers, and other marketers, and that’s just the beginning. Typical expenses for a company include the following:

Selling, general, and administrative expenses: Costs such as sales commissions and managerial salaries needed to generate sales and run the company

Research and development expense: Costs of finding and advancing innovative technologies needed to create new products

Interest expense: Costs of borrowing money, which companies must pay to their creditors

Income tax expense (also known as provision for income taxes): The portion of profits companies are usually required to pay to government authorities

Although cost of sales is always an expense, not every expense qualifies as cost of sales. Cost of sales is the actual cost of producing or buying the item you sell. However, your company may need to pay additional expenses, such as sales commissions and advertising, to sell this item.

The distinction between cost of sales and other expenses is important for determining gross profit, the difference between revenues and cost of sales. When calculating gross profit, you deduct cost of sales but not operating or other expenses.

How net income is measured

Net income (also known as profit) is the difference between revenues and all expenses, including cost of sales. Investors and managers often refer to net income because it provides a single bottom-line number to measure a company’s performance. (Of course, that figure is only considered profit when it’s a positive number; a negative net income is called net loss.)

You can use this formula to describe net income:

Net Income = Revenues – Expenses

Suppose Al’s Used Cars earns $1 million in revenue and has $600,000 in cost of goods sold and $300,000 in other expenses. To compute the net income, start with revenue and subtract all expenses, including cost of goods sold:

Net Income = Revenues – Expenses

Net Income = $1,000,000 – $600,000 – $300,000

Net Income = $100,000

This net income formula sets the structure for the income statement, where you start with revenues and then subtract from it cost of sales and all other expenses.

Having positive net income doesn’t necessarily guarantee positive cash flow. Even a profitable company may have to pay cash for additional costs not recorded as expenses, such as for new equipment or increased stores of inventory (assets, not expenses).

These payments require valuable cash flow but don’t affect net income. Similarly, companies don’t always collect sales immediately. Such a sale made on credit creates sales revenues, which help net income but not cash flows.

How return on sales is determined

Return on sales asks how much profit your company can squeeze out of its sales. Some companies, such as retailer Costco or the paper manufacturer Weyerhaeuser Company, benefit from a low-price, high-volume strategy. They keep profit margins very low so that they can charge customers the lowest prices possible. Because these companies usually yield relatively little profit from their sales, they usually have to make it up in volume to earn a healthy income.

Other companies, such as leather goods maker Coach or semiconductor manufacturer Intel, develop a high-price, low-volume strategy. These companies differentiate their products so that they can charge customers premium prices that yield rich profit margins and fairly high profits from their sales.

So how do you measure return on sales? Here’s the formula: