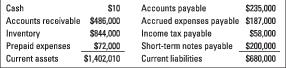

Wait a minute: a $10 cash balance? How can that be? Maybe your business has been having some cash flow problems and you’ve intended to increase your short-term borrowing and speed up collection of accounts receivable to help the cash balance. No one likes to see a near-zero cash balance — it makes them kind of nervous, to put it mildly, no matter how you try to cushion it. So what do you do to avoid setting off alarm bells?

Your controller is probably aware of a technique called window dressing, a very simple method for making the cash balance look better. Suppose your fiscal year-end is October 31. Your controller takes the cash collections from customers paying their accounts receivable that are actually received on November 1, 2, 3, and 4 and records these four days of cash receipts as if these cash collections had been received on October 31.

After all, the argument can be made that the customers’ checks were in the mail — that money is yours, as far as the customers are concerned.Window dressing reduces the amount in accounts receivable and increases the amount in cash the same amount — it has no effect on your profit figure for the period. It makes your cash balance look a touch better. Window dressing can also be used to improve other accounts’ balances, which isn’t covered here.

All these techniques involve holding the books open to record certain events that take place after the end of the fiscal year (the ending balance sheet date) to make things look better than they actually were at the close of business on the last day of the year.

Sounds like everybody wins, doesn’t it? You look like you’ve done a better job as manager, and your lenders and investors don’t panic. Right? Wrong! Window dressing is deceptive to your creditors and investors, who have every right to expect that the end of your fiscal year as stated on your financial reports is truly the end of your fiscal year.

However, there was a situation in which a major lender of the business was fully aware that it had engaged in window dressing. The lender did not object because it wanted the business to fluff the pillows to make its balance sheet look better. The loan officer wanted to make the loan to make the business look better. Essentially, the lender was complicit in the accounting manipulation.

Window dressing can be the first step on a slippery slope. A little window dressing today, and tomorrow, who knows? Maybe giving the numbers a nudge now will lead to more serious accounting deceptions or even out-and-out accounting fraud. Moreover, when a business commits some accounting hanky-panky, should the chief executive of the business brief its directors on the accounting manipulation? Things get messy, to say the least!

Be aware that window dressing improves cash flow from operating activities, which is an important number in the statement of cash flows that creditors and investors closely watch. Suppose, for example, that a business holds open its cash receipts journal for several days after the close of its fiscal year.The result is that its ending cash balance is reported $3.25 million higher than the business actually had in its checking accounts on the balance sheet date. Also, its accounts receivable balance is reported $3.25 million lower than was true at the end of its fiscal year. This makes cash flow from profit (operating activities) $3.25 million higher, which could be the main reason in the decision to do some window dressing.